Financials

Accounts above $200,000 usually attract a service fee of $225. The company most commonly works with Brink’s Global Service and Delaware Depository, which offers up to $1 billion in insurance. You should consult your own professional advisors for such advice. Opening a precious metals IRA can be a bit more complicated than setting up a standard IRA due to several differences. In our opinion, this is a great indicator of Augusta’s trustworthiness and expertise. Below are the top firms we’ve selected for your consideration. All this makes Birch Gold Group an ideal choice when looking for reliable investment opportunities within the precious metal markets today. Paid non client promotion: In some cases, we receive a commission from our partners.

List of The Top 10 Best Gold IRA Companies of 2023

Do they help you understand the technicalities behind a transaction or just do their own thing. These gold IRA companies reviews can provide you with insight into the different companies available and which one might be right for you. Wide range told a Las Vegas Review-Journal columnist of investment options. By partnering with the best gold IRA company, you can benefit from a seamless setup process, collaborate with a financial advisor who has the required industry knowledge, and select from an extensive range of precious metal coins and bullion. However, it’s important to note that managing a precious metals IRA can be complicated and costly. Well, typically, the process takes anywhere between three and ten days. Related investment reading. The first factor is purity, which gets measured in karats. Account set up: $50Wire transfer: $30Storage and Insurance: $100Management: $100.

7+ Best Virtual Conference Platforms of 2023 Ranked

A: Investing in a gold IRA has many benefits, including diversifying your portfolio, protecting against inflation, and providing potential tax benefits. Precious metal offerings include Gold, Silver, Platinum and Palladium. Gold investments in an IRA also provide you with the opportunity to take advantage of the tax benefits associated with traditional retirement accounts. Articles compiled by Philly Weekly’s editorial team. Goldco works with mints to source high quality coins eligible for gold IRAs, including. We also found Goldco’s in depth blog, eBooks, and educational videos very helpful for potential investors. Free gold is only for qualified customers who have at least $100K saved for retirement and who open a gold IRA with Augusta Precious Metals. Goldco strives to maintain a balance between investing, mining, and trading precious metals by purchasing gold from other sources.

:max_bytes(150000):strip_icc()/gold_ap11091515585-5bfc376246e0fb00511cc344.jpg)

Now is the time to save for your future

To ensure accuracy and fairness, a rigorous evaluation process was employed. This allows investors to buy gold and silver coins and store them at any place of their choice. Applying for a loan can also help you overcome financial situations. Goldco has received an A+ rating from the Better Business Bureau and a Triple A rating from Business Consumer Alliance. Unfortunately, when you invest in a gold IRA, you cannot keep the physical gold bullion at home. 100% Free IRA Rollover American Hartford Gold offers free storage, maintenance, and insurance for up to 3 years.

What is IRS approved gold?

The Gold Britannia, minted in. A gold and silver IRA, or Individual Retirement Account, allows investors to. The only divorce related exception for IRAs is if you transfer your interest in the IRA to a spouse or former spouse, and the transfer is under a divorce or separation instrument see IRC section 408d6. The top gold IRA companies offer a wide variety of investment options, such as gold, silver, platinum, and palladium. Economies suffer corrections, ultimately affecting any investment. Selling gold quickly can be tricky, particularly if you’re trying to sell a large volume at once. Since 1997, Lear Capital has been providing its services to a wide range of customers within the United States by offering an easy way through which they can diversify their retirement portfolio by adding gold and other precious metals. We do this to help you identify companies that will meet your specific buying needs, and we do not receive compensation for these designations. They have earned their reputation as one of the best gold IRA companies, and they are sure to provide you with a safe and secure experience. GoldCo is known for their excellent customer service and low fees.

4 Birch Gold Group

This depends upon your investment strategy, risk tolerance, and proximity to retirement. When it comes to investing in gold, it is important to do your research and compare the different best gold ira companies to find the one that best fits your needs. 3 Browse through your investment options and purchase the precious metals you want. You will also need to designate a custodian to oversee your IRA. Nonetheless, visiting various review sites should discover more about the organization and its consumers’ feelings. Check out our brochures that cover all of our IRA products and compare both Traditional and Roth IRAs. To start, you’ll have the chance to speak with a live representative who can assist you with your precious metals purchase. Augusta Precious Metals offers gold IRAs and cash purchases.

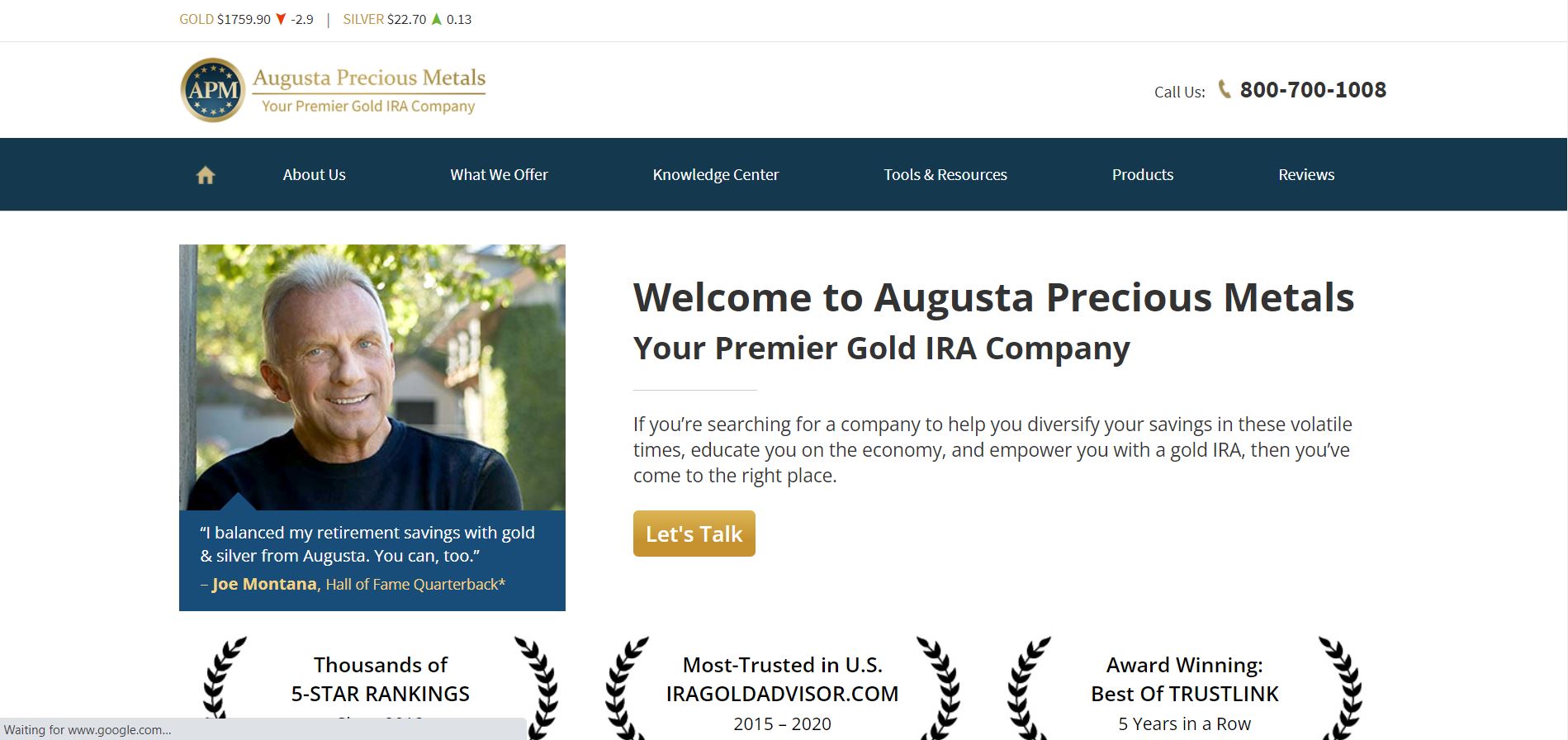

1 Augusta Precious Metals: Most Trusted Gold IRA

If you’re feeling really adventurous, you can also go digital and invest in some crypto for your golden years. A++++ Goldco made the process smooth and easy. This will ensure that they are compliant with the applicable laws and regulations, and that they are able to provide a safe and secure environment for your investments. Purchasing physical coins can leave you vulnerable to theft, fraud, or damage. In our research, we reviewed precious metals IRA firms based on the following criteria. You must conduct extensive research to find a suitable dealer. These customer friendly features make it easier for first time gold IRA investors to build up their precious metal portfolios from ground zero.

Pros

For example, gold bars must be 99. Right now, you can take advantage of their price match guarantee and save up to 30% in January 2023 and get up to $10,000 in FREE silver on qualified purchases. Experience the Difference with Advantage Gold. Investing in gold IRA accounts can provide numerous benefits for your retirement goals. The company offers gold and silver IRAs with access to bars and coins. 00 annually to keep it running, not including the fees you will incur when purchasing and shipping precious metals. If You’re Looking to Add Gold to Your Investment Portfolio, Check Out Noble Gold. To determine the best gold backed IRA companies, a comprehensive review was conducted to compare the features, benefits, and overall customer satisfaction. This step involves providing financial and personal information that qualifies them as an investor eligible for owning gold in their IRA account. On average, this fee is $50 per transaction.

Other Gold IRAs We Considered:

We strive to keep our list updated with the top gold IRA companies that meet these requirements. Their website is easy to navigate, and their fees are competitive. GoldCo has been rated as one of the best gold IRA companies by independent reviewers, and they have received numerous gold IRA reviews from satisfied customers. Oxford Gold Group Cons. Traditional investment vehicles such as stocks, mutual funds, or bonds rely heavily on the strength of the overall economy, leaving investors vulnerable to inflation and market volatility. Greg was so impressed that he recommended Allegiance Gold to his family as well. When you purchase precious metals through a gold IRA, you must store them outside your home, with a custodian, and in a secure depository. Augusta Precious Metals is one of the most trustworthy and reputable Gold IRA investment companies.

Gold Alliance: Cons Best Gold IRA Companies

Some web hosts offer free domain registration with the purchase of your web hosting package. The show and listeners value the insights the members of the team are able to provide about investing in precious metals and making sound financial decisions. 3 Browse through your investment options and purchase the precious metals you want. This way you can be comfortable with your investment decision and feel confident about your upcoming retirement. Per ounce measures may not recalculate due to rounding. In this way, we safeguard our customers’ nest eggs for the future.

Home Storage Gold IRA

A precious metals expert will help with account opening and filling out paperwork. 5, you’ll be subject to withdrawal fees. Augusta Precious Metals maintains an extensive product selection. They offer competitive prices, fast delivery, and excellent customer service, making the process of investing in gold hassle free. On their site, Lear Capital also provides various investor resources, so if you want a more hands on approach to investing in precious metals, this could be your company. All in all, Advantage Gold is one of the best gold IRA companies and is highly recommended. Generally, gold individual retirement accounts are more expensive to set up and maintain than traditional IRAs. Augusta Precious Metals: Your Trusted Partner in Gold IRA Investments.

Fees

Investing in a precious metals IRA provides individuals with a secure way to diversify their retirement portfolio. Discover the Value of Augusta Precious Metals: Invest in Quality and Security Today. While, the ruling did not overturn case law permitting an IRA to invest in a single member LLC, it did establish the unfettered control of IRA assets in the form of gold and silver, do constitute a distribution. Diversify Your Portfolio With American Hartford Gold Group: Invest in Precious Metals Today. You’ll simply need to fund your account via wire or a personal check. The precious metals that can be stored in a precious metals IRA are gold, silver, platinum, and palladium, and can come in many forms such as bullion coins, small bullion bars, and proof coins. The unique model of operation at Augusta usually ensures that each of their clients gets all their savings. The company has a long standing reputation for providing reliable, personalized service and offers a wide variety of gold IRA options that make it one of the best gold IRA companies. If you name a beneficiary in advance or make sure all paperwork is filled out properly at the time of setup, then the assets in your gold IRA will transfer directly into their hands upon your passing. A quick search online and there’s no shortage of precious metals firms advertising in hopes of earning your business.

Get unlimited digital access

They specialize in helping customers invest in gold and other precious metals. Fees: Minimum purchase of $25000 is required. However, if you are rolling over an existing 401k sponsored by your current employer, you should check their policies, though most do allow 401k to gold IRA rollovers and transfers. By choosing a reputable custodian and considering the potential risks and fees associated with the account, investors can make informed decisions about their retirement savings. The best gold IRA companies will provide a secure and reliable way to invest in gold and other precious metals. Augusta Precious Metals is one of the best gold IRA companies, providing customers with the best possible experience and value. Regal Assets believes in transparency regarding commissions and fees, but its team members don’t believe in the hard sell of higher cost products to boost the company’s take. Please enter your firstname.

CONS

Why it stands out: You can also roll over existing retirement accounts into a gold IRA — or a silver, palladium, or platinum IRA, if you choose — at Birch Gold Group. No matter what kind of purchase you’re making, their representatives will make the process quick and easy. A reputable gold IRA company can assist you with purchasing, storing, and selling your gold investments, as well as rolling over traditional IRAs, 401k’s, and eligible retirement fund account assets to a gold IRA account. If you don’t hold these assets in an IRA, there’s no need for you to bother with depository needs and complicated rules. American Hartford Gold. Goldco has received an A+ rating from the Better Business Bureau and a Triple A rating from Business Consumer Alliance. The rollover transfers value from a traditional retirement account to your gold IRA. Mint and Royal Canadian Mint. Below is the minimum fineness required for a gold and silver IRA. Roth IRA: Up to 3% interest. Visit American Hartford. Red Rock Secured is a reliable investing company in which they prioritize security, transparency, and consumer pleasure. Patriot Gold is a full service gold dealer with over 50 years of collective experience in the precious metals investment industry. GoldCo, American Hartford Gold Group, Oxford Gold Group, and Lear Capital are all top tier providers of precious metals IRAs.

Subscriptions

✅ White Glove Gold IRA Service. Their expert staff, competitive pricing, and commitment to excellent customer service make them an ideal choice for investors looking to protect their wealth with precious metals. Not only will those positions minimize the impact of unexpected market declines, but they’ll also provide you with liquidity to take advantage of stocks at lower prices. Our experts answer readers’ investing questions and write unbiased product reviews here’s how we assess investing products. The first and most obvious reason to own physical gold is for wealth preservation. Some may only store precious metals at one of these depositories, while other gold IRA companies will offer several options. 10% Back in Silver Coins for new customers. Augusta’s extensive experience and knowledge in the field is a part of their support network. With their commitment to excellence, Oxford Gold Group is an excellent choice for those looking to invest in gold. 😊Diversification: Investing in precious metals can help diversify an investment portfolio, as gold and silver tend to have a low correlation with stocks and bonds, potentially reducing overall risk. Various methods exist for investing in gold. Rating out of 5 stars: 4. You are not taxed when you purchase gold through a precious metals IRA.

Anna Miller

However, the Tax Code supplies an important statutory exception: IRAs can invest in 1 certain gold, silver and platinum coins and 2 gold, silver, platinum and palladium bullion that meets applicable purity standards. Read our full review to see why Joe Montana trusts Augusta with his fortune. Disclaimer: CPI Inflation Calculator is an independent calculator that is not affiliated with the BLS or the US Government. You only have to pay taxes when you make a withdrawal. They should also provide a secure storage facility for gold and other precious metals. Phone: 1 888 661 4281. You can choose a mix of gold and silver, and some gold IRA companies also have platinum and palladium available that you can buy and hold in your IRA. Investors can also roll their 401k or traditional IRA over into a gold IRA. The top rated gold IRA companies reviews in 2023 will be those that offer the most benefits and protections to their customers. 9/5 Stars From 283 Reviews. Oxford Gold Group is a highly reputable gold IRA company that offers a variety of services, from gold and silver IRA investments to gold and silver coins.

Gold Investment Options in India

Precious metals IRAs can hold coins, bars and rounds made from gold, silver, platinum and palladium. This free investors kit will explain everything you need to know about gold IRA investing. You’ll also benefit from the convenience of being able to invest online without having to leave home or visit a physical location. These precious metal coins offer alternative investment options — silver coins are typically more volatile than platinum or palladium but have a much lower cost of entry, while gold coins are less volatile in the short term but typically provide long term growth. The company doesn’t charge overall management fees. Once you’ve funded your precious metals IRA, you can choose the gold or silver you would like to purchase with your funds. Augusta Precious Metals is a gold and silver IRA company committed to delivering an exceptional customer experience. Q: What are the benefits.

Protect and Secure Your Retirement Savings Now!

Experience Exceptional Service with GoldCo: Try It Today. It has an average of 4. Noble Gold, Patriot Gold Club, Gold Alliance, Advantage Gold, Birch Gold Group, RC Bullion, GoldBroker and Augusta Precious Metals are all reputable gold IRA companies that offer comprehensive services. Provides access to industry experts for investment advice. If you’re a beginner with precious metal IRA or are eager to learn more about the rollover process, you can download a free guide on the company’s website. With their commitment to excellence, Augusta Precious Metals is the perfect choice for those looking to invest in a precious metals IRA. When you choose a gold IRA custodian, you can rest assured that your investments will be protected and your funds will be managed properly. While their IRA minimum is higher than some of their competitors, the company will facilitate non IRA transactions for as low as $3,500.